What is a mutuelle for freelancers?

A mutuelle is private health insurance that covers what Sécurité Sociale doesn't reimburse. It's essential for freelancers without employer-provided coverage. As a freelancer in France, you're responsible for your own health protection. A mutuelle typically costs €30-80/month and can be tax-deductible under the Madelin regime.

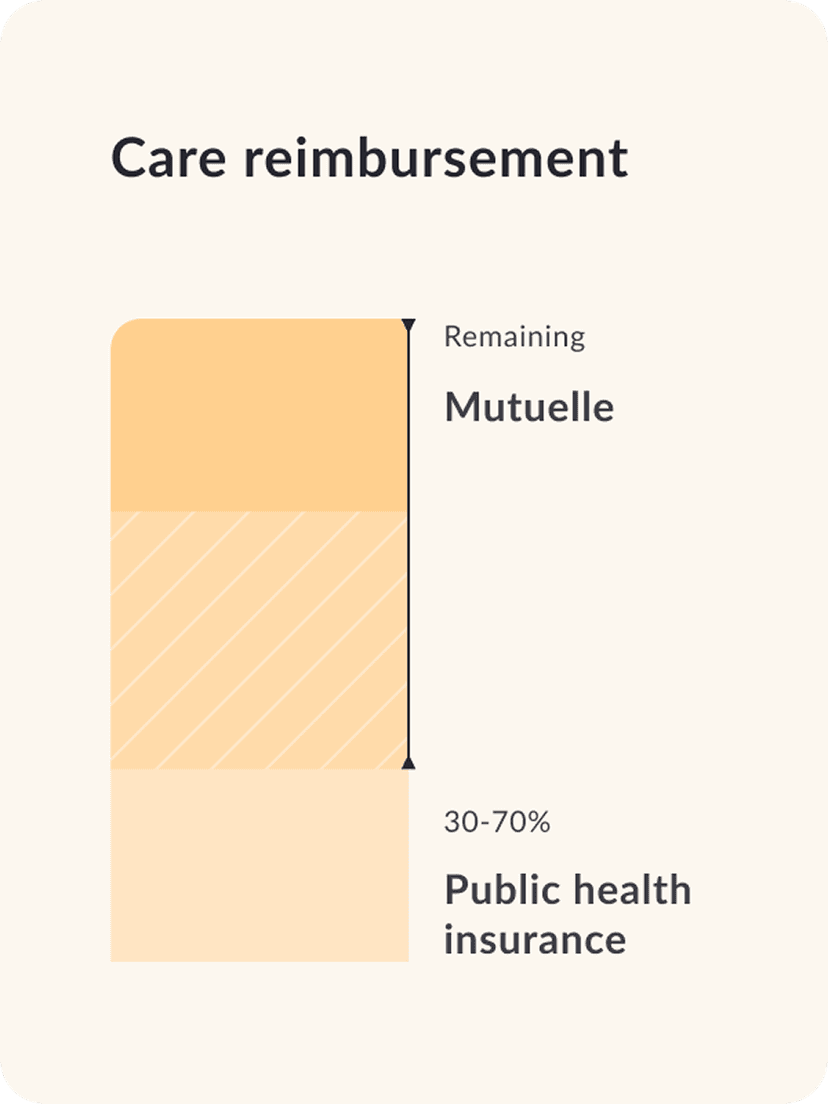

In France, healthcare has 2 parts:

First, public health insurance (PUMa / Sécurité Sociale)

Once you register your freelance activity, you’re eligible for the French public system (PUMA). It reimburses part of your care (30 to 70%) but not the full amount, especially for specialists, dental care, vision, and many routine medical costs.

Second, mutuelle (supplementary health insurance)

A mutuelle covers the portion that public insurance doesn't reimburse. Unlike employees, freelancers pay 100% of their mutuelle premium — but eligible BNC/BIC freelancers can deduct it from taxable income via Madelin.

Learn more about health insurance in France.

Protection for the self-employed lifestyle

As a freelancer, your health directly impacts your income. These services are included with your coverage:

Sick leave support

Daily-life assistance, including home help, childcare, and practical services when you can't work due to illness or hospitalisation.

Work-from-anywhere coverage (30 days/year)

Medical treatment covered during client visits or remote work stints outside France.

English teleconsultation — no time off work

Unlimited, 24/7 access to English-speaking doctors via MédecinDirect. Get a consultation between meetings.

Repatriation assistance

Organised return to appropriate care if you're injured while travelling for work or leisure.

Why freelancers & independents choose Feather

Better everyday coverage

- Higher reimbursement for GP visits and specialists

- No upfront payments with tiers payant

- Faster access to diagnostics and routine care

Designed for self-employed professionals

- Predictable, flexible monthly pricing

- Plans that fit your workload and lifestyle

- Eligible Madelin: Many freelancers (BNC/BIC/PL) can deduct mutuelle premiums from taxable income

Built for expats working in France

- Complete English-speaking support

- Fast onboarding and clear documentation

- Digital dashboard to follow reimbursements

- Perfect for freelancers navigating French healthcare for the first time

Ready for comprehensive coverage?

Get a quote in minutes

Which freelancers need a mutuelle?

Auto-entrepreneurs

You’re registered as an auto-entrepreneur and covered by Sécurité Sociale, but you still pay a lot for dental care, glasses, and some specialist visits. A mutuelle is a simple top-up that makes your healthcare costs more predictable while you grow your business.

Profession libérale (BNC/BIC)

Therapists, architects, designers, coaches, consultants, accountants and other profession libérale profiles can combine Sécurité Sociale with a mutuelle for stronger protection. With an eligible “responsable” contract, your premiums can often be deducted under the Madelin regime, improving both cover and tax efficiency.

Independent consultants, remote workers & creative freelancers

You work from France for clients everywhere. Feather gives you simple, online-managed cover with fast refunds, so you can focus on your clients, not on chasing healthcare paperwork.

New independents

You’ve recently left a permanent role and lost your employer-provided mutuelle. Feather lets you quickly set up equivalent top-up cover on your own, so you keep a similar level of protection as when you were an employee—just adapted to your new independent status.

Not yet registered in the French system?

If you're still waiting for PUMa or administration delays, Feather helps bridge the gap and ensures continuous coverage.

How to use your mutuelle as a self-employed

Ready for comprehensive coverage?

Get a quote in minutes

More reasons why freelancers choose Feather

Frequently asked questions

Do freelancers need a mutuelle in France?

Why do I need a complementary health insurance (mutuelle) in France?

Who is eligible for Feather's health insurance?

Can I have multiple complementary health insurance policies?

Am I covered worldwide with private health insurance?

See our FAQ page for more answers.