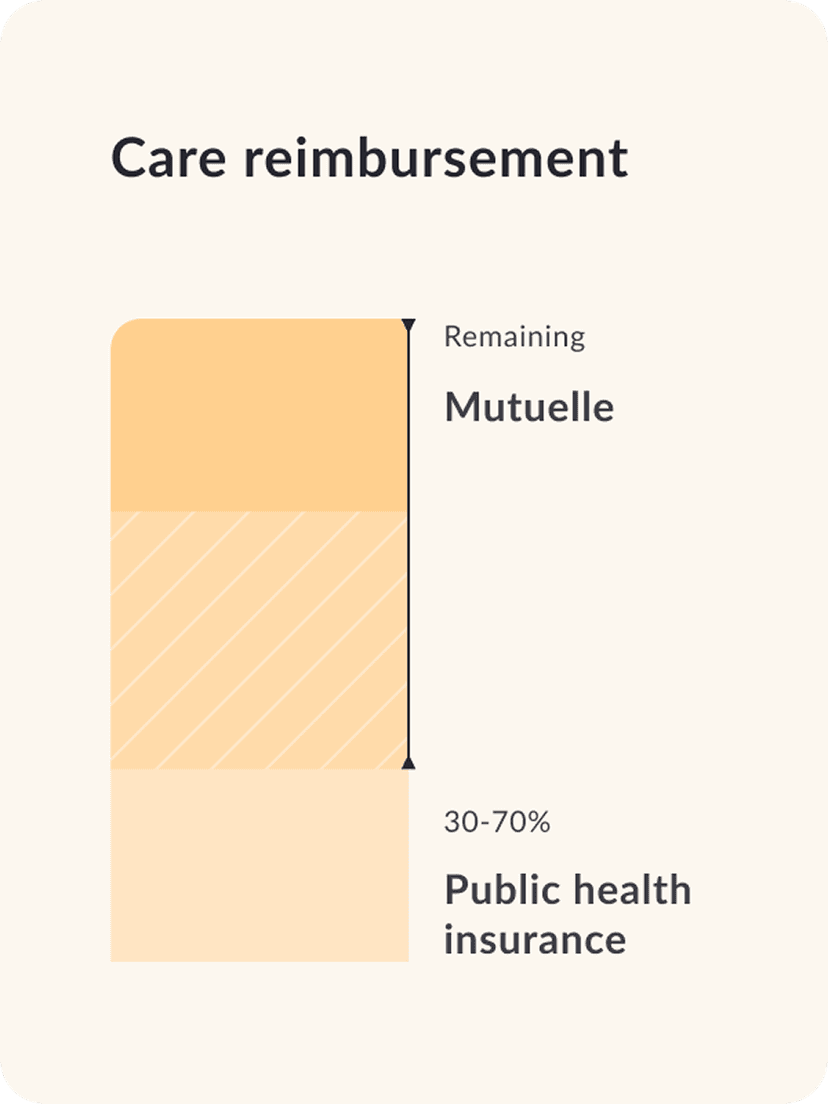

What is a mutuelle?

A mutuelle is a private health insurance in France that covers medical costs not reimbursed by the public system (Sécurité sociale). It typically costs €30-100/month and reimburses 30-100% of expenses for doctor visits, dental care, glasses, and hospital stays.

In France, healthcare coverage works in 2 layers:

1st Layer – Public Health Insurance

Once you're registered with French Social Security (Sécurité Sociale), the public system covers only part of your medical expenses:

- 70% of general practitioner and radiology visits

- 15% to 65% of medication costs

- 60% of nursing care, physiotherapy, and lab tests

2nd Layer – Private Health Insurance

Private health insurance (also known as a mutuelle or complémentaire santé) steps in to cover the remaining costs. It complements the public system and helps ensure you’re not left with out-of-pocket expenses.

Extra protections every expat needs

These additional services are included with your coverage.

Daily-life assistance

Home help, cleaning, childcare support, and practical services if you're hospitalised or temporarily immobilised.

Medical care abroad (30 days/year)

Worldwide medical treatment is covered during short stays outside France. If you need more, you can take a travel insurance.

24/7 English-speaking teleconsultation

Unlimited access to English-speaking doctors anytime via MédecinDirect.

Repatriation assistance

Organises and covers your return to a suitable medical facility if you fall seriously ill or are injured far from home.

Why expats choose Feather's mutuelle

1. No upfront payments

The tiers payant system, widely used in France, allows for direct billing between your healthcare provider and the insurer. This means you can enjoy medical care without worrying about advance payments—just present your mutuelle card along with your carte Vitale.

2. Better coverage and faster appointments

Private insurance helps cover fees from specialists who charge above the national base rate ("Secteur 2").

- Choosing a Secteur 1 doctor ensures full reimbursement by public insurance

- A Secteur 2 doctor might charge more, but private insurance can cover the difference — and they often have shorter wait times

This flexibility lets you choose the care that fits your schedule and needs.

3. Fully customizable

You choose what matters most: dental, vision, hospitalization. You can adjust your coverage and reimbursement levels depending on your lifestyle and budget. Clear options, no surprises.

Ready for comprehensive coverage?

You can get a quote in minutes

Who needs a mutuelle in France?

Freelancers & Self-employed

No employer coverage means you pay 100% of uncovered costs. A mutuelle protects your income from unexpected medical bills. Learn more.

Retirees & non-workers

Medical costs increase with age. Get peace of mind with customizable dental, optical, and hospitalization coverage. Learn more.

Students

Affordable plans from €30/month for essential protection during your studies — dental check-ups, glasses, GP visits. Learn more.

Employees

Your employer provides a mutuelle, but it may not cover everything. Feather offers top-up coverage for you and your family.

Families

Cover your partner and children on one plan. Adjust coverage levels for each family member's needs. Learn more.

Don't have a Carte Vitale?

Feather also offers Expat Health Insurance to help you get coverage before you're registered with Sécurité Sociale.

Is private health insurance mandatory?

"96% of people have a mutuelle. Not legally required, but common sense to get one."

Eloi Lanthiez, French insurance expert

For private sector employees

Since 2016, employers must provide group health insurance. They pay at least 50% of the cost; employees cover the rest.

For freelancers, public employees, retirees, families and students

Not mandatory, but highly recommended. You can get an individual plan to supplement your public coverage.

How to use your mutuelle

Why choose Feather for your mutuelle?

Don't take our word for it

Made it so much easier

“The conversation was super useful, and I’m really grateful for their support. I’d definitely recommend the Feathers app to anyone—it’s a great tool! ”

Ankit

Easy & understandable

“Shin hui tan answered every question in a very easy and understandable way! So thankful!!”

Aditya

Excellent service

“They make dealing with insurance a breeze: documents are easy to find, submitting claims is straightforward, and the team always provides quick support.”

Ardi

Frequently asked questions

Why do I need a complementary health insurance (mutuelle) in France?

Who is eligible for Feather's health insurance?

Can I have multiple complementary health insurance policies?

Am I covered worldwide with private health insurance?

See our FAQ page for more answers.