What is a mutuelle for retirees?

A mutuelle is private health insurance that covers what Sécurité Sociale doesn't reimburse — essential for retirees who typically use more healthcare services, from regular check-ups to dental work, glasses, hearing aids, and specialist visits.** Plans for seniors typically cost €60-150/month, depending on age and coverage level.

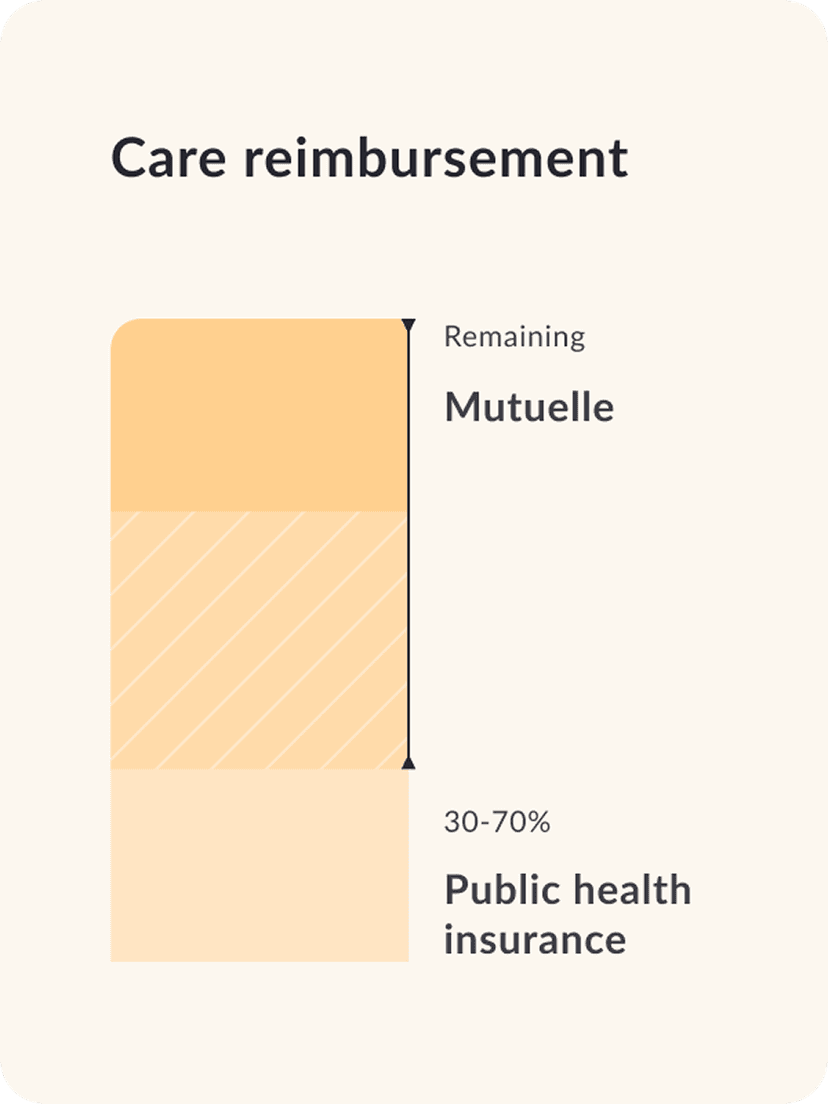

In France, your healthcare has two layers:

Public health insurance (PUMa / Sécurité Sociale)

Retirees living in France (with an S1 form or residency) access the French public healthcare, which reimburses around 30%–70% of medical costs. It covers basic care such as GP visits, partial hospital stays, prescriptions, and tests, but leaves notable gaps, especially in dental, optical, and hearing aid care, as well as specialists.

Mutuelle — private top-up health insurance

A mutuelle covers what Sécurité Sociale doesn't. It's key for retirees who need better dental, vision, hearing aid coverage, specialist access, and support for chronic care. With tiers payant, you often pay nothing upfront. Not with mutuelle.

Protection designed for retirement life

Healthcare needs change as you get older. These services are included with your coverage:

Home assistance after hospitalisation

Home help, cleaning, meal preparation, and practical support if you're hospitalised or temporarily immobilised — so you can recover comfortably.

Travel coverage for visits home (30 days/year)

Medical treatment covered during trips to visit family abroad or holidays outside France, wherever retirement takes you.

24/7 English-speaking teleconsultation

Unlimited access to English-speaking doctors via MédecinDirect. Get medical advice without leaving home.

Repatriation assistance

Organised return to appropriate care if you become seriously ill far from home — for you and your spouse if travelling together.

Why retirees choose Feather

Stronger day-to-day and long-term care

Top-up coverage that reduces out-of-pocket costs for GP visits, specialists, dental, optical, medication, diagnostics, and chronic condition follow-ups.

Made for English-speaking retirees

Clear guidance, easy onboarding, and full support in English — ideal if you're navigating the French healthcare system for the first time.

Predictable, flexible coverage

Transparent monthly pricing with plans you can adjust anytime, ensuring your healthcare stays aligned with your needs in retirement.

Ready for comprehensive coverage?

Get a quote in minutes

Which retirees need a mutuelle in France?

Foreign retirees living in France

You’re settled in France and covered by Sécurité Sociale, but you’ve realised it leaves you paying a lot for dental work, glasses, and some specialist visits. A mutuelle helps reduce these extra costs so you can use the French system fully without worrying about the bill every time.

Retirees with an S1 form

You’ve registered an S1 and are now in the French public system, but only for the basics. A mutuelle strengthens your cover where the S1 and Sécurité Sociale are weakest – especially dental, optical, and certain specialist fees – so you’re not surprised by big out-of-pocket bills.

Couples retiring together

You and your partner have moved to (or are moving to) France for retirement. You may not have the same medical history or needs, but you both want reliable cover. With Feather, each partner gets their own mutuelle contract and coverage level, while you still manage everything easily from one account.

Retirees with chronic conditions or regular care needs

You see doctors and specialists more often – for chronic conditions, follow-ups, scans, or recurring prescriptions. With only Sécurité Sociale, the “reste à charge” adds up quickly. A mutuelle helps keep ongoing costs for consultations, exams, and treatments under control so you can focus on your health, not the invoices.

Waiting for your S1 or Carte Vitale?

If you're still waiting for your S1 activation or PUMa registration, we can help you navigate the process and stay protected in the meantime.

How to use your retiree mutuelle

Get your mutuelle quote and be well covered.

It takes 3 minutes. If you are not sure or have questions, book a call with an expert.

Why you'll love Feather

Frequently asked questions

Do I need a mutuelle if I have an S1?

How much does a mutuelle cost for retirees in France?

Who is eligible for Feather's health insurance?

Can I have multiple complementary health insurance policies?

Am I covered worldwide with private health insurance?

Does mutuelle cover hearing aids?

See our FAQ page for more answers.