Why get pension insurance?

Statutory pension insurance only may not cover your basic expenses. Therefore, the government advises topping up with a private plan.

Full flexibility

Increase, decrease, or pause your monthly contributions based on your lifestyle. Withdraw money whenever you want.

Take the pension with you anywhere in Europe

Unsure about staying in Germany long-term? No problem, your pension plan will move with you.

No upfront fees

Don't pay any extra at the start, so more of your money can go towards investments.

Estimate your pension

Approximately

€ —

Advantages of pension insurance

Choose the best way to get your pension

• One-off payment

• Monthly pension for the rest of your life

• Some split between the two above

Tax efficient payouts

Normally, you have to pay taxes on profits from investments. With the Feather pension plan, you'll have considerable tax advantages from the start of your retirement.

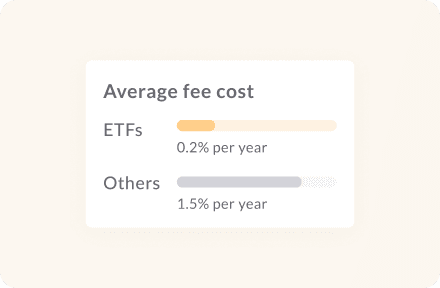

Our general fees

• Upfront fees: €0

• Management: €1.50 monthly + €0.5% per year

• Investment: €0.2% per year

Cost efficiency

Our policy is an ETF-based product; ETFs usually have cheaper fees compared to other regular mutual funds. This means you keep more of your money over time.

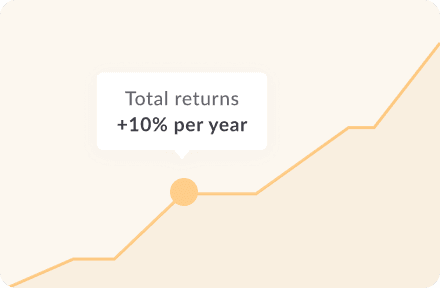

Profit potential

ETFs let you invest in the stock market, so you can make money as the market grows over the years. That’s why this is the smartest way to build up retirement savings for the future.

Ready to save for your future?

Sign up in 5 minutes

Why Feather?

Don't take our word for it

Feather is a one stop insurance shop

“They cover everything I need and even a few things I might consider in the future - if you are American and don’t receive a work-sponsored pension program, you NEED to look into this.”

Austin

Laura was very informative and friendly

“She made a complicated subject straightforward with her in-depth knowledge. Whilst it was not a sales pitch, her presentation certainly convinced me to use Feather.”

Jonathan

5/5, would recommend

“I'm looking for a private pension plan and I've easily scheduled an introduction call with Julian. He was really helpful, patient and friendly while answering all of my questions. 5/5, would recommend”

Martin

Extremely friendly, personal, and helpful

“No paperwork like with traditional German insurances, and all done in a few clicks. Pricing is perfectly reasonable as well.”

Frans

Frequently asked questions

How much money should I pay, and can I adjust it later?

Is it possible for me to withdraw money, and if so, are there any limitations in place?

When I retire, do I get monthly or one-off payments?

Can I pause paying and then resume without canceling the plan?

How does the "flexibility on location" work? Can a person outside Germany subscribe?

Can I sign up for the Feather pension product as an American?

What happens to the money if you die?

Does my employer contribute to my pension plan?

Ready to save for your future?

Sign up in 5 minutes